Polymer Binders Market Introduction and Overview

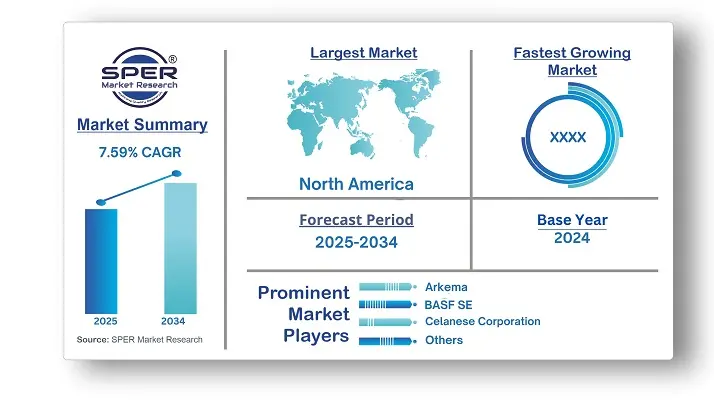

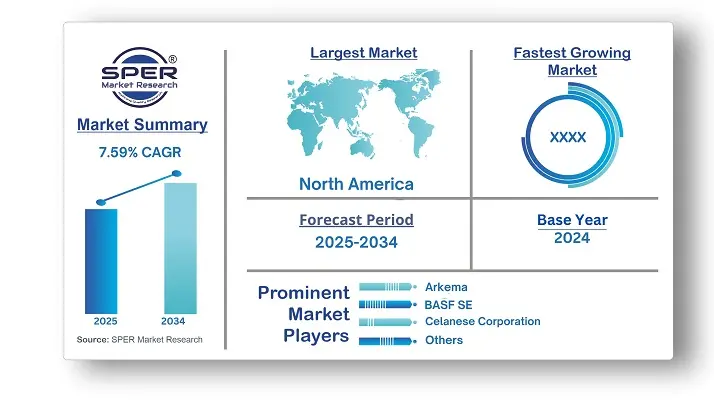

According to SPER Market Research, the Global Polymer Binder Market is estimated to reach USD 75.67 billion by 2034 with a CAGR of 7.59%.

The global polymer Binders market was valued at USD 75.67 billion in 2024 and is predicted to increase at a CAGR of 7.59% from 2024 to 2034. The polymer binders industry is predicted to increase significantly in the next years. The market is being driven by rising demand in the construction, automotive, and packaging industries, the development of water-based binders, and environmental regulations that encourage green products. Furthermore, increasing urbanization, infrastructure development, and innovation in polymer technology are likely to drive market expansion. Continuous polymer research and development has resulted in enhanced binders with superior qualities such as increased strength, adhesion, and durability. These advances are likely to provide new market opportunities by broadening the uses of polymer binders.

In December 2024: Trinseo has introduced LIGOS BH 7340 SCE Binder, a biodegradable bio-hybrid binder for coated paperboard products. LIGOS BH 7340 SCE binder can replace a large amount of synthetic binder in coatings. The product has various benefits that are comparable to typical paper or paperboard coatings with synthetic binders. This offers outstanding coater run ability, cohesive coating strength, and adhesive capability.

In December 2023: The School of Energy and Chemical Engineering developed a novel binder technology that promises to improve battery performance. The company intends to dramatically improve the performance of silicon cathode-based secondary batteries by manufacturing high-electrical conductivity polymer binders that are readily available.

By Type:

The polymer binders market is divided into acrylic, vinyl acetate, latex, polyurethane, polyester, and others. Vinyl acetate dominated the polymer binders market in 2024, accounting for more than 34%. Vinyl acetate polymer binders are widely used in many construction applications such as paints, sealants, and adhesives. Strong adhesion, flexibility, and water resistance are important properties that make them excellent for improving the performance and lifetime of building materials. Acrylic polymer binder is predicted to increase at a CAGR of 7.5%. The increased requirement for protective coatings in industrial applications such as machinery and equipment is predicted to drive up demand for acrylic polymer binders.

By Form:

The polymer binders market is divided into three segments: powder, liquid, and high solids. The powder category had the biggest revenue share of XX% in 2024. Powder-based polymer binders are essential in dry mix mortars because they promote workability, adhesion, and durability. The growing construction sector, particularly in emerging markets, increases demand for these materials. The liquid form is predicted to expand at the greatest CARG of 7.2% in the next years. Liquid-based binders are commonly used in machinery, equipment, and infrastructure because they resist corrosion, chemicals, and wear. Liquid polymer binders are vital in architectural paints and coatings because they improve adhesion, durability, and weather ability. The demand for high-performance coatings in residential and commercial buildings is propelling market expansion.

By Application:

The polymer binders market is divided into paints and coatings, adhesives, textiles, construction, and others. Paints and coatings dominated the polymer binders market in 2023, accounting for more than 37.34%. The polymer binder market is crucial in paint and coating applications, offering a variety of advantages to fulfill the needs of various industries. Polymer binders improve the durability, adhesion, and mechanical properties of paints and coatings. They contribute to the formation of a cohesive coating, which increases resistance to abrasion, chemicals, corrosion, and UV radiation, hence extending the life of coated surfaces. The adhesives segment is predicted to rise at a substantial CAGR of 7.4%. Polymer binders are crucial components in adhesive formulations, providing adhesion, cohesion, flexibility, and durability.

By Regional:

Asia-Pacific dominated the worldwide Polymer Binders market in 2024. It has a revenue of more than USD XX billion in 2024. Rapid industrialization, urbanization, and vigorous economic development in nations such as China and India have driven up demand for construction materials, coatings, and adhesives, resulting in increased use of polymer binders. The construction sector, in particular, has contributed significantly to the region's market share, with growing infrastructure projects fueling the demand for high-performance and long-term binding solutions. The growth of the automobile industry in Asia-Pacific drives up demand for polymer binders, particularly in coatings and adhesives applications, as manufacturers seek innovative materials to improve performance and durability.

Market Competitive Landscape

The Global Polymer Binder Market is highly consolidated. Some of the market players are Arkema, BASF SE, Celanese Corporation, Dairen Chemical Corporation, New Materials Co., Ltd., Mayfair Biotech Pvt. Ltd., OMNOVA Solutions Inc., The Lubrizol Corporation, Toagosei Co. Ltd., VINAVIL S.p.A., Wacker Chemie AG and others.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Form, By Application |

| Regions covered | Arkema, BASF SE, Celanese Corporation, Dairen Chemical Corporation, New Materials Co., Ltd., |

| Companies Covered | Arkema, BASF SE, Celanese Corporation, Dairen Chemical Corporation, New Materials Co., Ltd., Mayfair Biotech Pvt. Ltd., OMNOVA Solutions Inc., The Lubrizol Corporation, Toagosei Co. Ltd., VINAVIL S.p.A., Wacker Chemie AG and others. |

Key Topics Covered in the Report

- Global Polymer Binder Market Size (FY’2025-FY’2034)

- Overview of Global Polymer Binder Market

- Segmentation of Global Polymer Binder Market By Type (Acrylic, Vinyl Acetate, Latex, Polyurethane, Polyester and Others)

- Segmentation of Global Polymer Binder Market By Form (Powder, Liquid and High Solids )

- Segmentation of Global Polymer Binder Market By Application (Paints & Coatings, Adhesives, Textiles, Construction and Others)

- Statistical Snap of Global Polymer Binder Market

- Expansion Analysis of Global Polymer Binder Market

- Problems and Obstacles in Global Polymer Binder Market

- Competitive Landscape in the Global Polymer Binder Market

- Details on Current Investment in Global Polymer Binder Market

- Competitive Analysis of Global Polymer Binder Market

- Prominent Players in the Global Polymer Binder Market

- SWOT Analysis of Global Polymer Binder Market

- Global Polymer Binder Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Polymer Binder Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Polymer Binder Market

7. Global Polymer Binder Market, By Type 2021-2034 (USD Million)

7.1. Acrylic

7.2. Vinyl Acetate

7.3. Latex

7.4. Polyurethane

7.5. Polyester

7.6. Others

8. Global Polymer Binder Market, By Form 2021-2034 (USD Million)

8.1. Powder

8.2. Liquid

8.3. High Solids

9. Global Polymer Binder Market, By Application 2021-2034(USD Million)

9.1. Paints & Coatings

9.2. Adhesives

9.3. Textiles

9.4. Construction

9.5. Others

10. Global Polymer Binder Market, 2021-2034 (USD Million)

10.1. Global Polymer Binder Market Size and Market Share

11. Global Polymer Binder Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Arkema

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. BASF SE

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Celanese Corporation

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Dairen Chemical Corporation

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Mayfair Biotech Pvt. Ltd.

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. OMNOVA Solutions Inc.

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. The Lubrizol Corporation

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Toagosei Co. Ltd.

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. VINAVIL S.p.A.

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Wacker Chemie AG

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.